Tweet

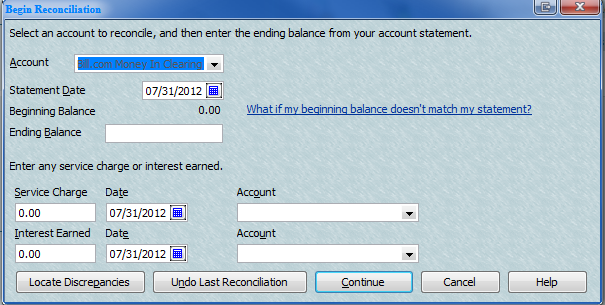

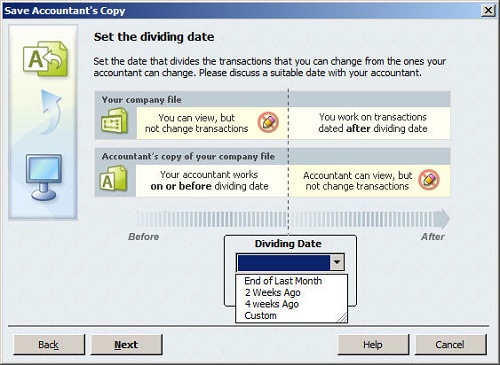

Although it may seem like drudgery, reconciling your bank account is a critical accounting task that you should carry out each month. Doing so helps ensure the integrity of your financial reports, since most of your accounting transactions ultimately affect cash in some fashion.

Further, QuickBooks is a much more powerful tool for your [...]

Tweet

Although it may seem like drudgery, reconciling your bank account is a critical accounting task that you should carry out each month. Doing so helps ensure the integrity of your financial reports, since most of your accounting transactions ultimately affect cash in some fashion.

Further, QuickBooks is a much more powerful tool for your [...]

Bank Reconciliation Tips and Tricks

Tweet

Although it may seem like drudgery, reconciling your bank account is a critical accounting task that you should carry out each month. Doing so helps ensure the integrity of your financial reports, since most of your accounting transactions ultimately affect cash in some fashion.

Further, QuickBooks is a much more powerful tool for your [...]

Tweet

Although it may seem like drudgery, reconciling your bank account is a critical accounting task that you should carry out each month. Doing so helps ensure the integrity of your financial reports, since most of your accounting transactions ultimately affect cash in some fashion.

Further, QuickBooks is a much more powerful tool for your [...]

Overlooked Reports you should use

Tweet

Just about every QuickBooks user relies on the Report Center and Reports menu, but if you’re like most, you have a small handful of reports that you tend to rely on. I want to explore some reports that many users overlook. Even if you are using some of these reports, we’re sure you’ll find a few more to add to your rep [...]

Backup or Portable? – You decid...

Tweet

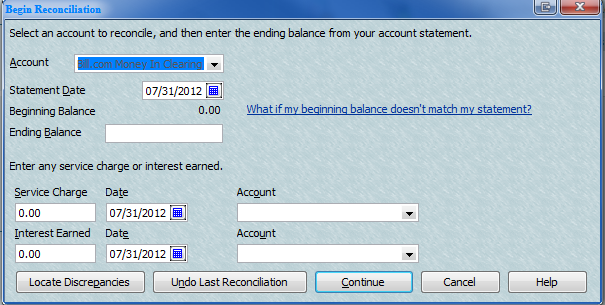

When you think about it, it’s pretty amazing that QuickBooks is able to pack the lion’s share of your financial data into one giant company file. It certainly makes it easier to separate from QuickBooks and move when necessary.

There are actually three options for saving and relocating that file. You know about backups, sinc [...]

Tweet

When you think about it, it’s pretty amazing that QuickBooks is able to pack the lion’s share of your financial data into one giant company file. It certainly makes it easier to separate from QuickBooks and move when necessary.

There are actually three options for saving and relocating that file. You know about backups, sinc [...]

Tips For Cutting Expenses

Tweet

It looks like the economy may finally be looking up – maybe. Still, this is no time to loosen the purse strings in terms of your business expenses. Rather, why not re-double your efforts to cut costs and boost your profitability?

Excessive expenses cause debt, which in itself can be very costly. So any money-saving actions you tak [...]

Tweet

It looks like the economy may finally be looking up – maybe. Still, this is no time to loosen the purse strings in terms of your business expenses. Rather, why not re-double your efforts to cut costs and boost your profitability?

Excessive expenses cause debt, which in itself can be very costly. So any money-saving actions you tak [...]

Time and Expenses Billing

Tweet

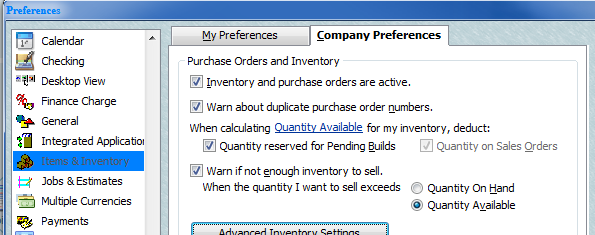

Billing for inventory parts is easy. Pick the items from a list and specify a quantity then, Done.

Billing for costs, time or mileage is a little more complex. QuickBooks has built-in tools to help you do this, but it’s a bit of a process.

To simplify your workflow, do this groundwork first:

Go to Edit | Preferences | Time & [...]

Tweet

Billing for inventory parts is easy. Pick the items from a list and specify a quantity then, Done.

Billing for costs, time or mileage is a little more complex. QuickBooks has built-in tools to help you do this, but it’s a bit of a process.

To simplify your workflow, do this groundwork first:

Go to Edit | Preferences | Time & [...]

More Common Errors in QuickBooks

Tweet

Account for outstanding bank account transactions.

If you’re having a problem reconciling your latest bank statement, the problem might be with outstanding bank account transactions.

If there was any lag time between the date of your statement and your start date in QuickBooks, make sure that you also entered any checks or deposit [...]

Tweet

Account for outstanding bank account transactions.

If you’re having a problem reconciling your latest bank statement, the problem might be with outstanding bank account transactions.

If there was any lag time between the date of your statement and your start date in QuickBooks, make sure that you also entered any checks or deposit [...]

Income Tax Reports – Tax line m...

Tweet

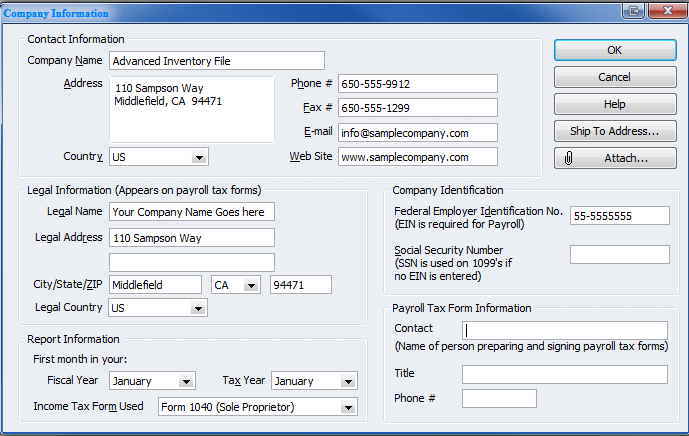

QuickBooks, of course, can’t do your taxes for you. But it helps you lay some of the groundwork. Following up on last weeks post on customizing reports, we’ll look at the program’s tax-related reports and its powerful report-filtering options.

But first, you’ll need to make sure that this output will be accurate. [...]

Tweet

QuickBooks, of course, can’t do your taxes for you. But it helps you lay some of the groundwork. Following up on last weeks post on customizing reports, we’ll look at the program’s tax-related reports and its powerful report-filtering options.

But first, you’ll need to make sure that this output will be accurate. [...]

Modifying your reports for better ins...

Tweet

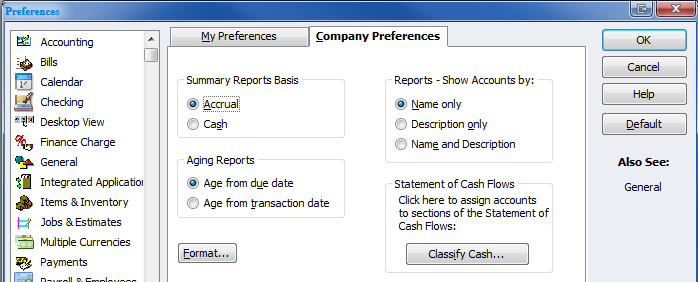

If you make one resolution about improving your accounting procedures, it should be this:

Make extensive use of the tools that QuickBooks offers for report modification.

Comprehensive, meticulously-shaped reports that flow out of your carefully-constructed records and transactions are your reward for pounding on the keys every day, co [...]

Tweet

If you make one resolution about improving your accounting procedures, it should be this:

Make extensive use of the tools that QuickBooks offers for report modification.

Comprehensive, meticulously-shaped reports that flow out of your carefully-constructed records and transactions are your reward for pounding on the keys every day, co [...]

When to use Classes or types in Quick...

Tweet

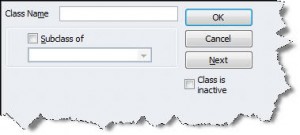

QuickBooks‘ standard reports are critical to understanding your company’s past, present, and future. But the program also offers innovative tools that can make them significantly more insightful and comprehensive.

QuickBooks offers two simple conventions that let you identify related data: classes and types.

Classes are us [...]

Tweet

QuickBooks‘ standard reports are critical to understanding your company’s past, present, and future. But the program also offers innovative tools that can make them significantly more insightful and comprehensive.

QuickBooks offers two simple conventions that let you identify related data: classes and types.

Classes are us [...]

Bill Tracking in QuickBooks

Tweet

QuickBooks Pro New Features Saves You 50% Time Spent on Finances. Save 20% + Free Shipping.

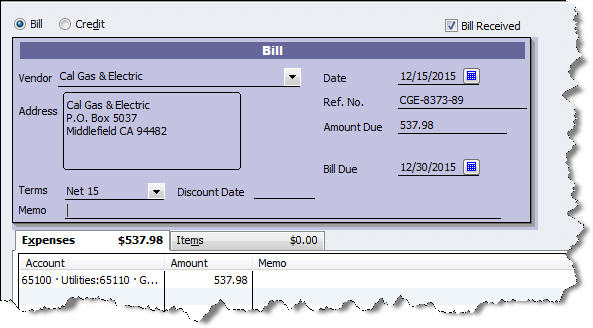

Next to payroll, paying bills is probably your least favorite task in QuickBooks. You don’t have to use this feature — you can keep stacking bills on your desk, scrawling the due dates on a paper calendar, and writing checks.

If you&# [...]

Tweet

QuickBooks Pro New Features Saves You 50% Time Spent on Finances. Save 20% + Free Shipping.

Next to payroll, paying bills is probably your least favorite task in QuickBooks. You don’t have to use this feature — you can keep stacking bills on your desk, scrawling the due dates on a paper calendar, and writing checks.

If you&# [...]