QuickBooks‘ standard reports are critical to understanding your company’s past, present, and future. But the program also offers innovative tools that can make them significantly more insightful and comprehensive.

QuickBooks offers two simple conventions that let you identify related data: classes and types.

- Classes are used in transactions.

- Types are assigned to individual customers, vendors, and jobs.

For example;you might use classes to separate transactions that relate to different departments, locations, or types of business. A construction company might want to track classes using New Construction, Remodel, andOverhead. Your customer types might help you isolate groups by characteristics like Industry or Geographical Location.

First, make sure that QuickBooks is set up to use classes. Go to Edit | Preferences | Accounting | Company Preferences. Make sure that Use class tracking is checked. If you want to be prompted for a class designation in transactions, check that box, too. QuickBooks already contains a Type field in customer, vendor, and job records.

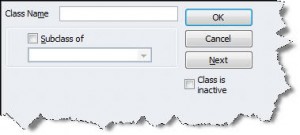

It’s easy to build lists of options for both. To define classes, go to Lists | Class List. In the bottom left corner of the screen, click on Class, then select New from the menu. You’ll see this:

Figure 1: To create a class, just give it a name and click OK

Figure 1: To create a class, just give it a name and click OK

Let’s say that you’re a contractor and you want to separate remodeling jobs into room types, like Bathroom or Kitchen. Go through the above steps again. Enter “Bathroom” in the Class Name field and click the box next toSubclass of. Open the list and choose “Remodel.” Click OK.

Tip:

If your class list grows lengthy and you want to tidy it up, you can make classes that you’re not currently using inactive by checking the box in this window. It will remain in your QuickBooks records and can be reactivated again.

Now you can use classes in transactions. Open a blank invoice and select a customer. The Class field will be next to the customer name. If the entire invoice will be assigned to the same class, click the drop-down list and select it. You can also assign separate classes to individual line items:

Not all invoice templates include a column for classes. You can add this by selecting the invoice form you want to modify and clicking Customize in the toolbar.

QuickBooks comes with two reports specially designed for tracking class-based transactions: Profit & Loss by Class and Balance Sheet by Class (both can be found in the Reports menu, under Company & Financial). Of course, you can filter other reports to include a class column. You can also create a QuickReport for individual classes. Go to Lists | Class List and select a report or graph.

Figure 3: You can filter by class in QuickBooks reports.

Warning!

The Balance Sheet by Class report is complicated and may produce unexpected results. Let your ProAdvisor help you work with this one. They can also help you set up a solid class structure.

Customer, vendor, and job types are a bit less complicated. Job types are especially useful; you can track, for example, profitability and time spent on individual projects. Customer and vendor types can produce output for things like targeted mailings and reports.

Creating types is very similar to creating classes. Go to Lists | Customer & Vendor Profile Lists, and select the type you want to work with. You’ll follow the same instructions here as you did for classes. Types do not appear on transactions; they’re designed for your own internal use, and they’re stored in records.

Classes and types can be used very effectively in your bookkeeping, but they require a good deal of thought and planning upfront to get accurate, meaningful reports. Let your ProAdvisor (Need to find a QuickBooks ProAdvisor?) know if he/she can assist as you attempt to use these powerful forms of classification.

Related articles

- Get the Job Done and Track Costs too!

- Classes or Types? When To Use Them in QuickBooks

- Job-Tracking – Precision for your QuickBooks Company

- Review: QuickBooks 2012 makes great strides, but still falls short

- First Look: QuickBooks for Mac 2012

© 2012, Bruce Mc. All rights reserved.