Non sufficient funds – Handling NSF Checks in QB

Non sufficient funds

Non sufficient funds

No-one likes it when their clients/customers payments come back as NSF (non sufficient funds).

When you receive notice that a check has bounced, you need to follow these directions for recording this into QuickBooks.

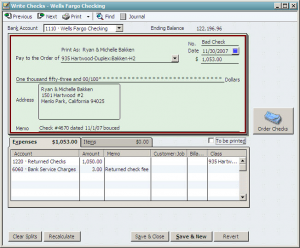

Create a transaction that records the funds coming out of your checking account, along with the fee the bank charged. You will need the following in order to create this transaction:

Accounts

• Returned Checks (Other Current Asset)

• Bank Service Charges (Expense)

Items

• Bounced Check (Service item linked to Returned Checks account)

• Bounced Check Fee (Other Charge item linked to Other Income account)

Write a check to record the transaction as shown.

When you receive a replacement check or re-deposit the original check, create a NEW sales receipt for the bounced check. DO NOT void or delete the original invoice. You can also record a fee that’s charged to clients for bounced checks, on the sales receipt.

Record the Sales Receipt as shown. In Date, enter the date of the re-deposit or the date the replacement check was received.

In “Deposit To” select “Un-deposited Funds”, or if you’ve deposited it by itself, select the account you deposited the funds into.

For more QuickBooks tips please visit my QuickBooks Tips page.