- Balance Sheet and P&L

- Balance Sheet and P&L

Now that you have allowed yourself the time, you can take your time reviewing your Balance Sheet, Profit and Loss, and even your Statement Of Cash Flows In QuickBooks. This is a crucial step in tax planning with QuickBooks so that by the time you turn your books over to your tax professional you know the books are ready. This should minimize the time they need to spend on bookkeeping so they can focus on what you hired them for – tax return preparation.

There are a few reports you should run as a standard for reviewing your QuickBooks file for yearend and tax prep purposes.

- Standard Balance Sheet

- Standard Profit and Loss

- Comparative Balance Sheet

- Comparative Profit and Loss

- Monthly Balance Sheet

- Monthly Profit and Loss

Review Your Standard Balance Sheet

All bank accounts and all Credit Card accounts must be reconciled monthly! The standard balance sheet in QuickBooks will give you some insights right away. Are your bank balances correct? Are the accounts reconciled? Any other assets on the books like employee advances, pre-paid expenses should look accurate to you. If you have no idea what something is or you are not absolutely certain the number looks right then you want to double click the number and drill in to see what is in there. Once you do this it is usually best to total that report by payee so you can see very clearly what is there and then in an instant you will most likely know whether or not it’s right.

Do this for the entire Balance Sheet and 90% of any cleanup work needed on your books. The Equity section can be tricky so don’t worry too much about that. I do have several videos on YouTube that will help you better understand this. Just review my whole section on “Cash Flow” and you will have a better foundation for this.

Review Your Standard Profit and Loss

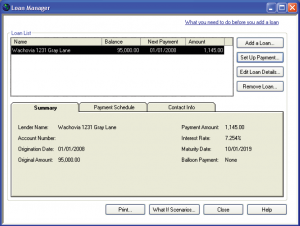

Once the balance sheet is reviewed most of the P&L will have been affected by that review because of the direct relationship that items on your balance sheet have to items on the P&L. For example if you have loans on the books then you’ve reviewed the loan balances and in the process, whether you realize it or not you have just double checked that your “interest expense” is accurate. So the review of the profit and loss statement in QuickBooks should be a little faster. Still you want to check that the numbers look right and as the owner of the business no one is in a better position to know this than you. If you are not the business owner then you want to go through this exercise WITH the owner of the business. They are in a position to be able to catch things that no one else can catch because of their intimate relationship to their business. They have their eyes on every aspect of the business so they more than anyone will have insights as to when something doesn’t look right.

Once you have completed the review of the P&L then you should have the books pretty well cleaned up. My video will walk you through this process as well as the analytical review which is what the rest of the suggested QuickBooks reports are designed to help you with.

- Segment 1

- Segment 2

- Review your QuickBooks File – Balance Sheet and P&L - You are here

- Segment 3

- Segment 4

© 2012, Bruce Mc. All rights reserved.